Jerry Gulke: Is There New Life for the Wheat Market?

I don’t often write about wheat, but that does not diminish its importance — especially with the invasion of Ukraine. Wheat has traveled a path that was certainly not on the horizon of wheat producers or traders.

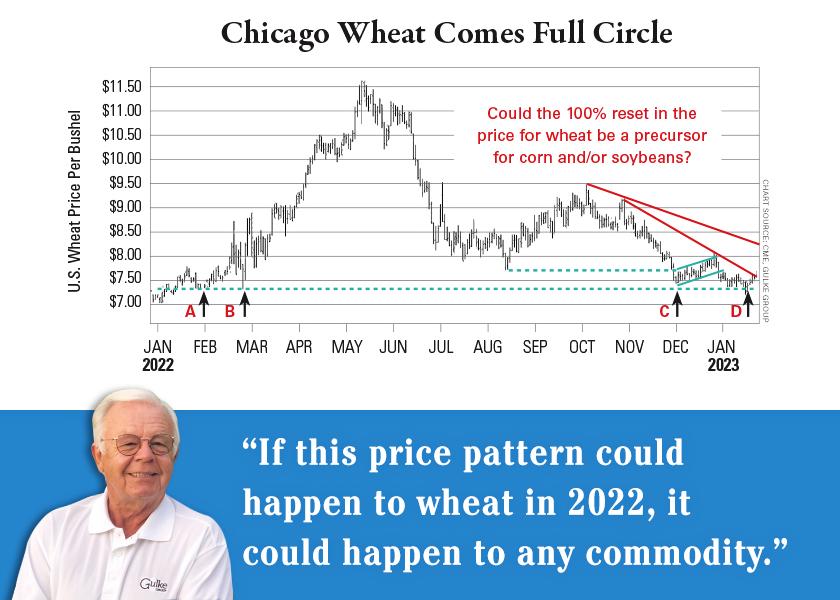

The saga started at point B (see chart above), which printed a 50¢ trading range in response to the Ukraine invasion and revalidated the lows made at the beginning of 2022 (point A). Force majeure was declared by wheat suppliers to European processors that were caught short. That caused a “get me out” mentality and May prices exploded to $11.60 — a 57% jump.

A NEW BEGINNING

The rest is history with the resetting back to prices not seen since a year before (point C versus point A and B). Prices in January 2023 (point D) retested lows as if trying to revalidate that the collapse of 2022 had gone far enough.

Prices move in three directions: up, down or sideways. July Chicago wheat has completed all three. The most recent downtrend is finally being broken with a sideways pattern. Will prices rally now?

Just about everyone in the world raises some wheat. A bull market is started when a major supplier comes up short and can’t satisfy its customers. Price rationing occurs.

THE UPSHOT

Technically speaking the price action of Chicago, Kansas City and Minneapolis wheat varieties are signaling a change is coming — one that might not be recognized until the price ship has sailed.

A 50% retracement comes to mind, which coincidentally matches the high ($9.50) made Oct. 1, 2022. However, with 2.5 million more acres of all wheat planted for 2023, that is a tall order.

Price volatility has not been limited to wheat. The high in May 2022 corn near $8 to the recent December futures at $6 comes to mind (that’s a $350-per-acre range). In the same time frame, soybeans ranged $4.

If this price pattern could happen to wheat in 2022, it could happen to any commodity. High prices, a recovery in South American crops and global uncertainty mean continued price risk.

Read More

Jerry Gulke: Do the Negatives Outweigh the Positives in Grain Price Outlook?

Jerry Gulke: Did the USDA Reports Create A New Paradigm Shift in Grain Prices?

Check the latest market prices in AgWeb's Commodity Markets Center.

Jerry Gulke farms in Illinois and North Dakota. He is president of Gulke Group Advisory Services.

Learn more at GulkeGroup.com

Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.